General

Sri Lanka Rs1,310mn dollars in arrears up to June

ECONOMYNEXT – Sri Lanka has issued a statement after a virtual meeting with officials creditors in another step towards securing assurances on debt restructuring after the country defaulted in the wake of prolonged monetary instability due to money printed for output gap targeting (stimulus).

The government is committed to halting money printing, the statement said.

However the central bank from 2015 had printed money to suppress rates usually monetizing past deficits (buying back maturing debt already sold to banks and the public in prior) through open market operations under ((overnight injections, term reverse repo inejctions and outright purchases) ‘flexible inflation targeting’.

Analysts have called for tight laws to prevent economists from engaging in aggressive open market operations mi-using ‘central bank independence’ given by politicians as happened under Finance Minister Mangala Samaraweera who hiked taxes to reduce the deficit.

From 2015 Sri Lanka was also persuing ‘revenue based fiscal consolidation’ a pro-state strategy of taking more taxes from the people without cutting expenses (avoiding spending based consolidation) that saw spending as a share of GDP jump from 17 percent in 2014 close to 20 percent, by 2019.

Sri Lanka saw serial currency crises in a country that emerged from a 30-year war, under flexible inflation targeting (employing floating rate style open market operations to suppress rates while operating a reserve collecting peg) which led to output shocks as well as heavy foreign borrowing (so-called ‘cover-up’ loans).

At the end of the currency crisis, a soft-pegged central banks in Sri Lanka and in Latin America prints very large volumes of money to sterilize interventions, buying back government debt to inject liquidity and it is then mis-classified as deficit monetization.

Sri Lanka has now allowed rates to go up and money printing has largely halted. The central bank ran out of reserves to intervene on a net basis after ACU deferred payments ended.

The full statement is reproduced below:

Ministry of Finance and Central Bank hold virtual meeting with Official Creditors

The Sri Lankan authorities held a virtual meeting with Sri Lanka’s official creditors today (3 November 2022). The meeting was chaired by the Secretary to the Treasury and the Ministry of Finance, Mr. K M Mahinda Siriwardana, and the Governor of the Central Bank of Sri Lanka, Dr. P. Nandalal Weerasinghe.

Sri Lanka remains fully committed to advancing engagements with all its creditors in an equitable and transparent way.

The meeting represented another important step towards securing International Monetary Fund (IMF) Board approval for Sri Lanka’s IMF program.

The State Minister of Finance, Mr. Shehan Semasinghe, said:

“Sri Lanka is at a critical stage, and we are seeking IMF program approval as soon as possible so that we can restore macroeconomic stability. We are grateful to our bilateral partners for their continued engagement and support during this process. The IMF program and our ambitious economic reforms will restore public debt sustainability, help protect the most vulnerable and restart our growth engine. This government is focused on re-establishing social and economic prosperity, and ensuring our citizens have access to critical public services.”

The Governor of the Central Bank of Sri Lanka, Dr. P. Nandalal Weerasinghe, said:

“The IMF program and economic reform agenda will reconstitute Sri Lanka’s financial buffers. I thank the official creditors for joining this productive meeting where we were able to discuss Sri Lanka’s current financial position and progress on reforms.”

Sri Lanka reached a Staff-Level Agreement with the IMF on a four-year program supported by the Extended Fund Facility on 1st September 2022. The program, amounting to USD 2.9bn, is expected to restore macroeconomic stability and debt sustainability while protecting the vulnerable and safeguarding Sri Lanka’s financial system. This agreement remains subject to IMF Executive Board approval.

The IMF program has been centred around Sri Lanka’s ambitious reform program. The government’s reform agenda is based on four pillars:

1. The first pillar is fiscal reform. The program foresees the implementation of ambitious revenue-based fiscal consolidation measures, combined with revenue administration reforms and the introduction of fuel and electricity pricing mechanisms to minimize fiscal risks stemming from SOEs. It also includes the enhancement of existing social safety nets to protect the most vulnerable;

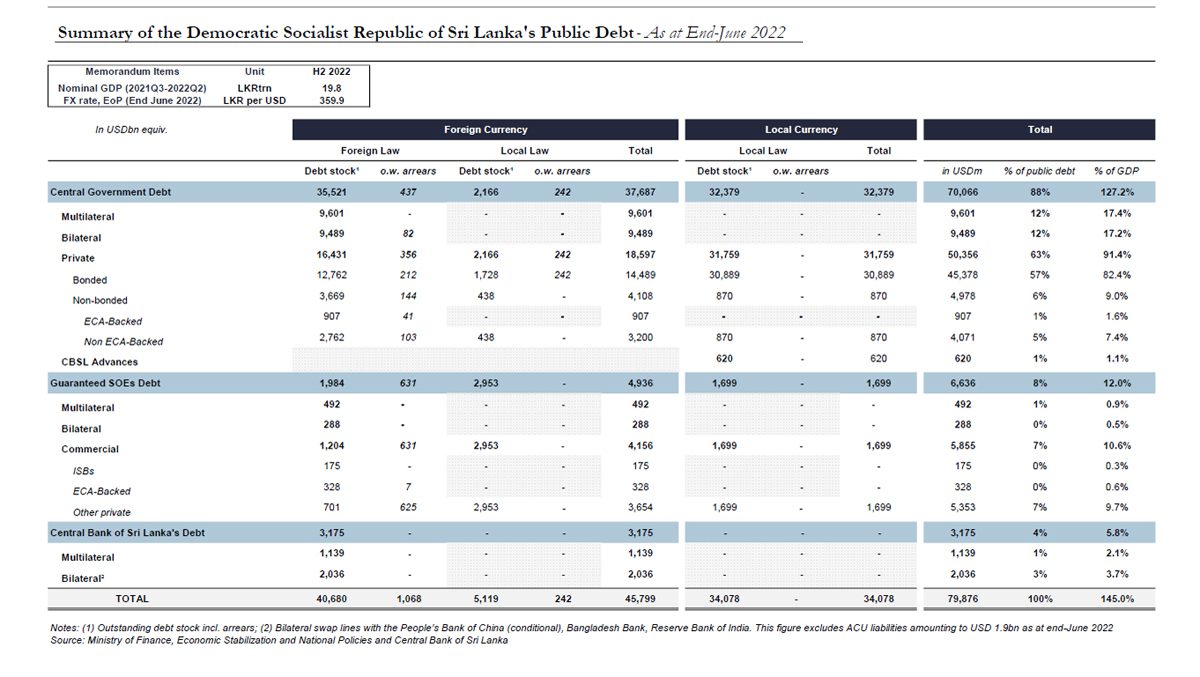

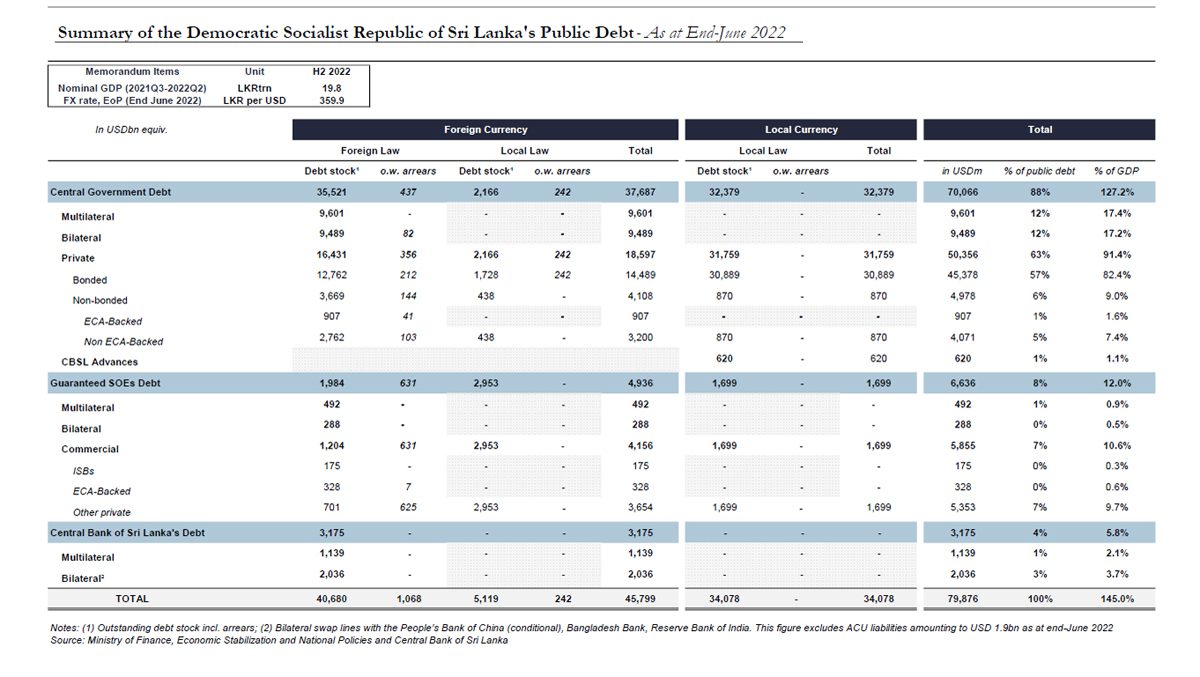

2. The second pillar will be to restore public debt sustainability. Sri Lanka’s debt situation has been deemed unsustainable by the IMF and will need to be addressed by a comprehensive debt treatment;

3. Thirdly, the program will aim to restore price stability and rebuild external buffers. The government is committed to refraining from any monetary financing and the Cabinet will soon approve the Central Bank Act that will strengthen the Bank’s independence and modernise its policy framework;

4. The fourth pillar of the program is the safeguarding of financial system stability, a key condition to Sri Lanka’s economic recovery. This will be achieved by ensuring that Sri Lanka’s banking system is adequately capitalised and by strengthening the resilience and governance of its state-owned banks.

5. In addition to these pillars, the government will introduce a series of anti-corruption reforms that will align Sri Lanka’s legal framework with international standards and will implement broader structural reforms to unlock Sri Lanka’s growth potential.

For any domestic media enquiries, please contact [email protected]

For any investor or international media enquiries, please contact [email protected]