General

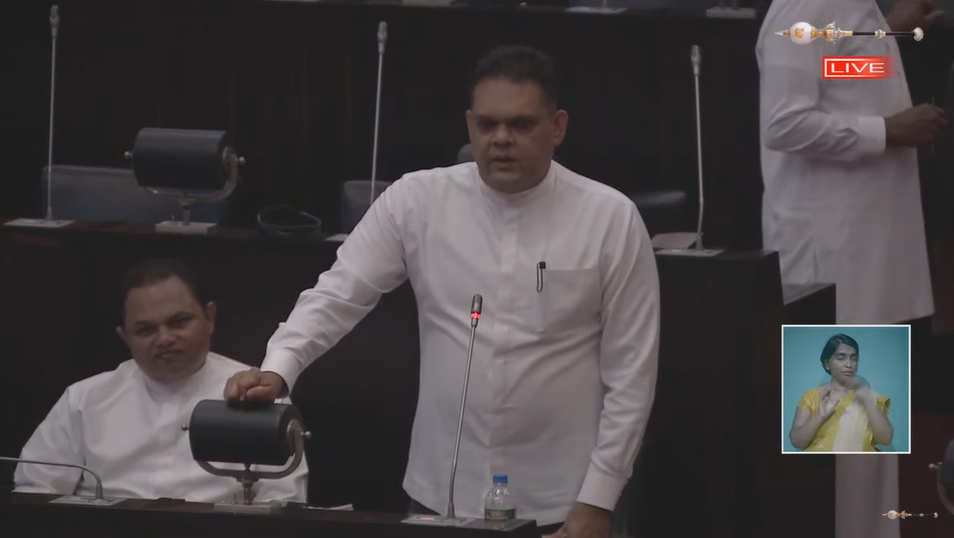

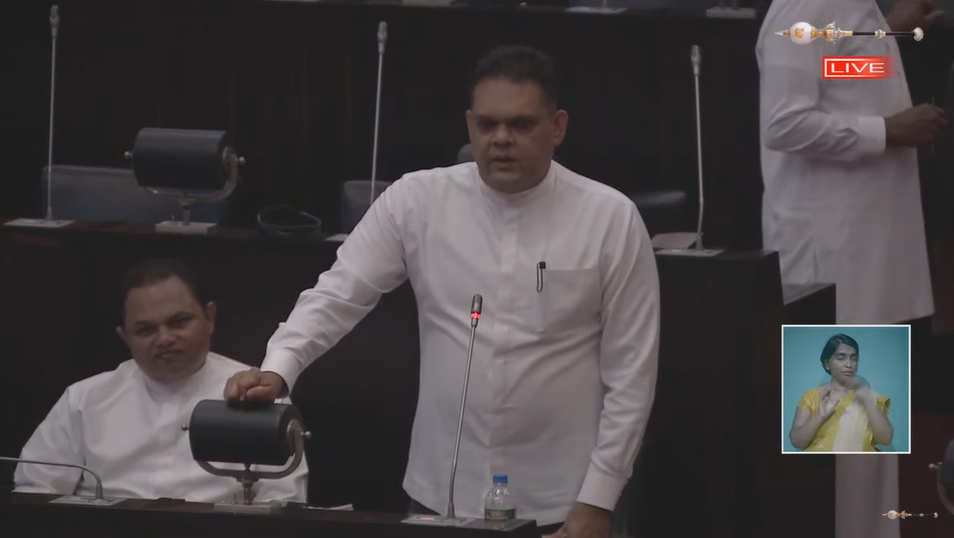

Sri Lanka needs quick bilateral creditor consent to get IMF deal this year: Minister

ECONOMYNEXT – Sri Lanka is planning to have another meeting with creditors shortly after sessions with official and private creditors in Washington, State Minister for Finance Shehan Semasinghe said as the country tries to wrap a up deal with the International Monetary Fund.

IMF officials have asked Sri Lanka to complete prior actions under a staff level agreement early, he said.

A key requirement is to get assurance of debt restructuring from bilateral lenders, including China and India.

“If we are go get IMF funds this year we need to get bilateral creditor agreement by the beginning of next month,” Minister Semasinghe told parliament.

Sri Lanka’s delegation has met representatives of all official creditors in a common platform for the first time, and shared information on current economic situation and answered their queries.

“As part of the restructuring process the Sri Lanka delegaton had a chance to meet all bilateral lenders on a common platform,” Minister Semansinghe said.

“We told the current economic situation, the financial situation and medium term middle term. We gave information on IMF support and economic reforms and main requirements.

“We hope to have another meeting and clarify more questions.”

Sri Lanka had also met Paris Club (representing Western lenders and Japan) officials, and committed to share more data and information, he said. India and China are non-Paris Club lenders.

In the case of Zambia, there was a delay with China giving debt restructuring assurances.

In the case of Sri Lanka, India and China are top lenders, but the tow geopolitical rivals.

President Ranil Wickremesinghe said he had talked with China’s Finance Minister. More consultations were expected after Chinese Communist Party congress ends.

The IMF has also urged Sri Lanka to complete prior actions under the program quickly, Minister Semasinghe said.

Prior actions include passing a budget for 2023 which will legitimize tax increases needed to raise revenues and reduce the budget deficit.

Sri Lanka also has to float the currency.

However the central bank in April hiked rates reducing private credit, and allowed government securities yield also to go up reducing the need to print money, the reason for forex shortages and balance of payments deficits in a pegged regime.

Sri Lanka has also raised utility tariffs and also imposed new taxes to reduce the deficit and domestic credit and money printing has largely reduced.

An approval of the IMF Executive Board for a deal will also unlock budget support loans from other lenders.

Sri Lanka has already requested the World Bank group not to consider Sri Lanka as a Middle Income country and give concessional lending, Semasinghe said.