General

Sri Lanka firms could be hit from import ban, rising costs, rates: Fitch

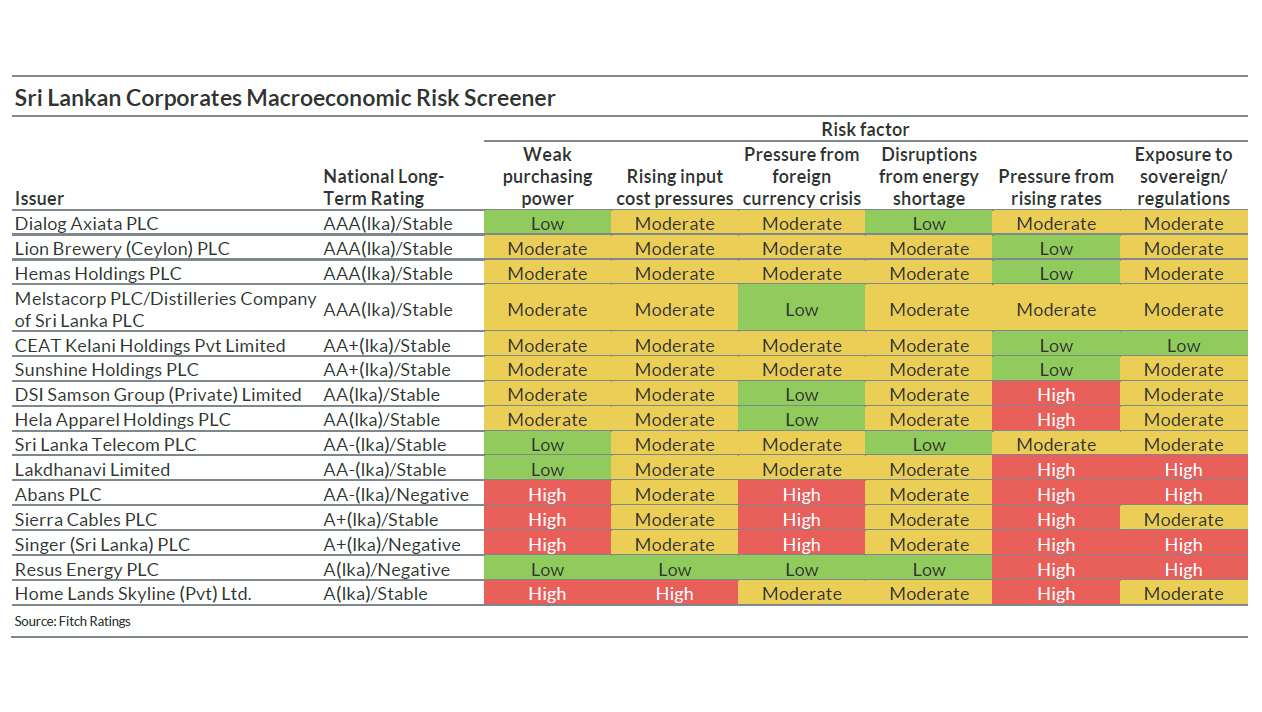

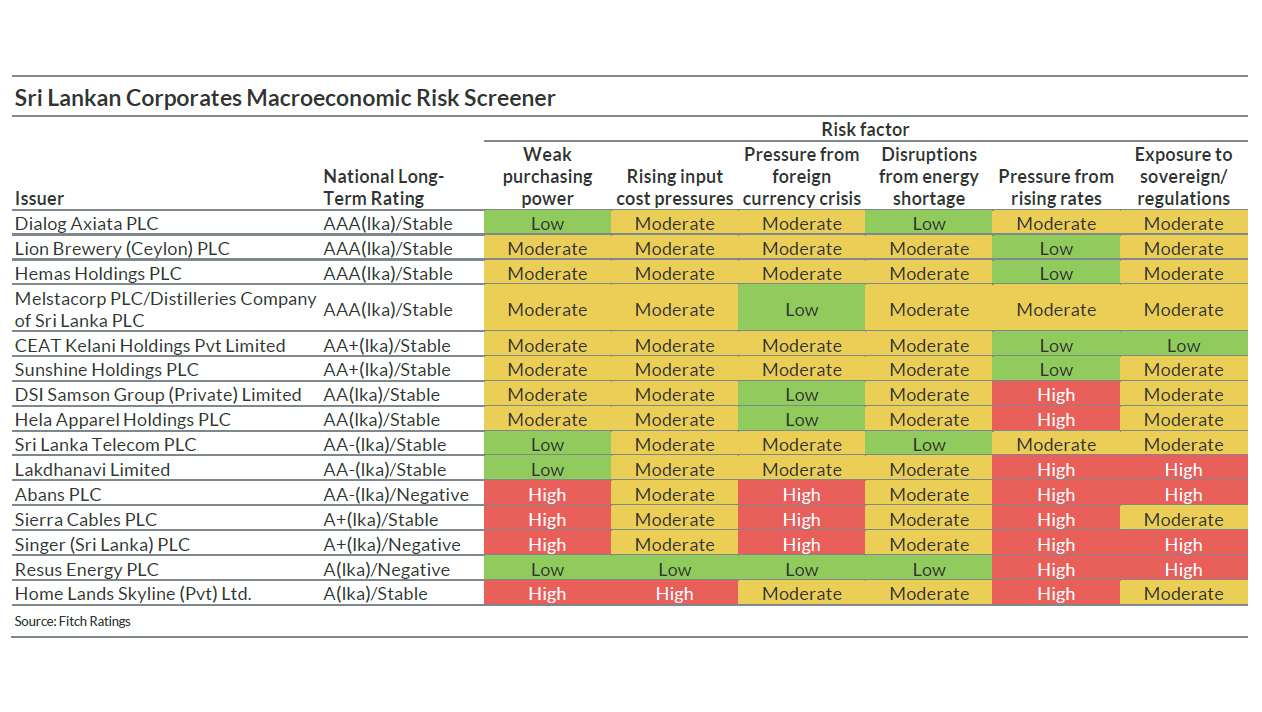

ECONOMYNEXT – About 50 percent of the companies could rated by Fitch could see their credit pressured if economic conditions worsens in the next 12 to 18 months, the rating agency said as Sri Lanka grapples with the worst currency crisis in the history of its central bank.

Sri Lanka printed money for two years to keep rates down on top of a tax cut for ‘stimulus’ which led to steady depletion of foreign reserves especially at the economy recovered from a Covid lockdown.

An extension of an import ban beyond the next six months, a further rise in interest rates, prolonged high inflation leading to difficulties in raising selling prices could hurt firms.

In April 2022 Sri Lanka defaulted on its foreign debt and has also tightened domestic payments.

“..[D]elays in receipts from government counterparties could lead to a rapid deterioration in some companies’ liquidity positions while leverage and interest coverage could weaken beyond our negative rating sensitivities,” Fitch said.

Many companies rated by Fitch had shown good results up to June 2022.

“Most rated corporates posted strong revenue growth and expanding margins in their June 2022 quarterly results due to inflation-led price hikes and sale of lower-cost inventory purchased prior to the sharp devaluation in the local currency in March 2022,” the rating agency said.

“However, the cost of new inventory has risen sharply since then, while high inflation and falling affordability will make it challenging to raise selling prices further.

“There is also a significant increase in operating costs, which will be reflected more acutely in the next few quarters, and it is likely to pressure cash flow.”

Sri Lanka has since raised energy prices and also taxes. (Colombo/Oct19/2022)