General

In Sri Lanka reserve money expansion is ‘proper’ money printing: CB Governor

ECONOMYNEXT – Sri Lanka’s central bank is watching the asset quality of banks which are facing a number of pressures bad loans, changes in interest rates and exchange rate, Governor Nandalal Weerasinghe said.

“We are basically looking at each bank one by one potential risks they could face going forward in terms of the rising NPL’s and interest rate impact and exchange rate impact,” he told reporters.

“Going forward one of the exercises we are doing is asset quality review for us to understand the kind of stress if banks are going to face in the future.

“And then based on assessment we can work with the bank and come out with a recommendation on how to deal with that that situatio¬n”.

In Sri Lanka bad loans tend to rise after interest rate corrections are made to half currency crises triggered by excess credit and falls in loans to deposit ratios seen during such episodes.

In this episode, a Coronavirus crisis had added to bad loans, including in the tourism sector.

So called Stage 3 bad loans have climbed steadily from 8.4 percent of total loans and advances in the first quarter of 2022, to 8.9 percent in the second quarter and 10.9 percent in the third quarter.

The central bank and accounting regulators had given some leeway to banks to account for mark to market losses.

Governor Weerasinghe declined to comment on any potential re-structuring of domestic debt at the present time. Sri Lanka’s government has said no decision has been made to re-structure domestic debt.

The central bank has also started to ease liquidity in banks after looking at whether liquidity shortages were increasing pressure on banks.

“That is why we have introduced several schemes to support liqudity if there is any need – short term,” he said.

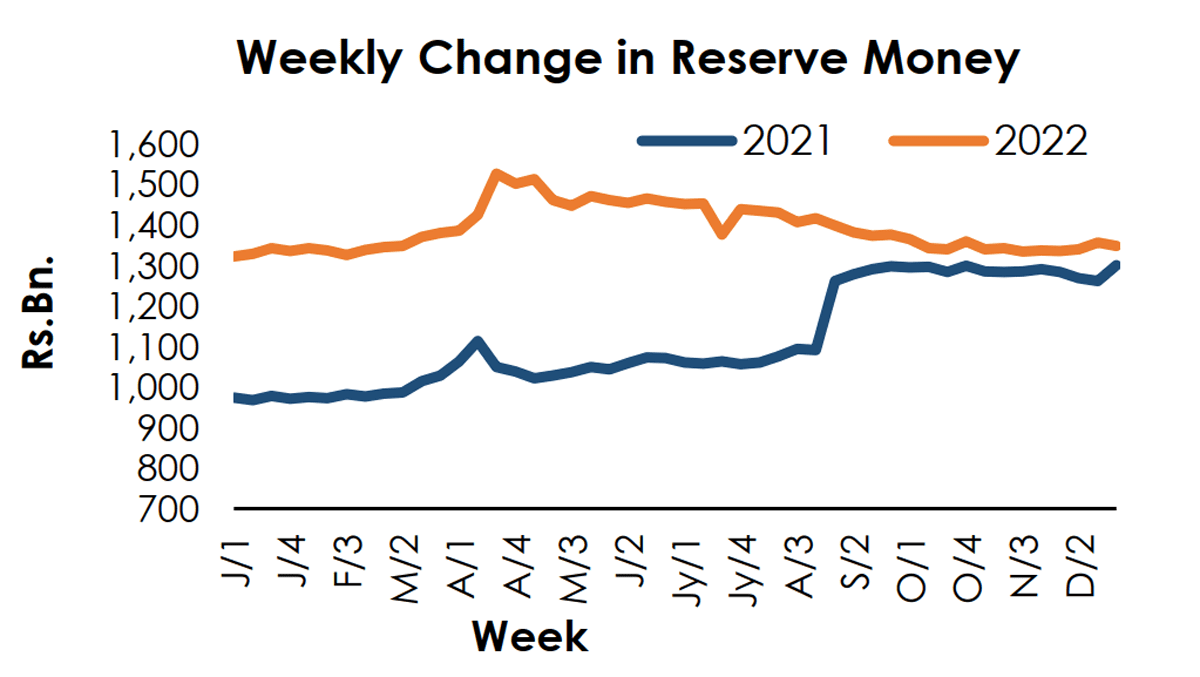

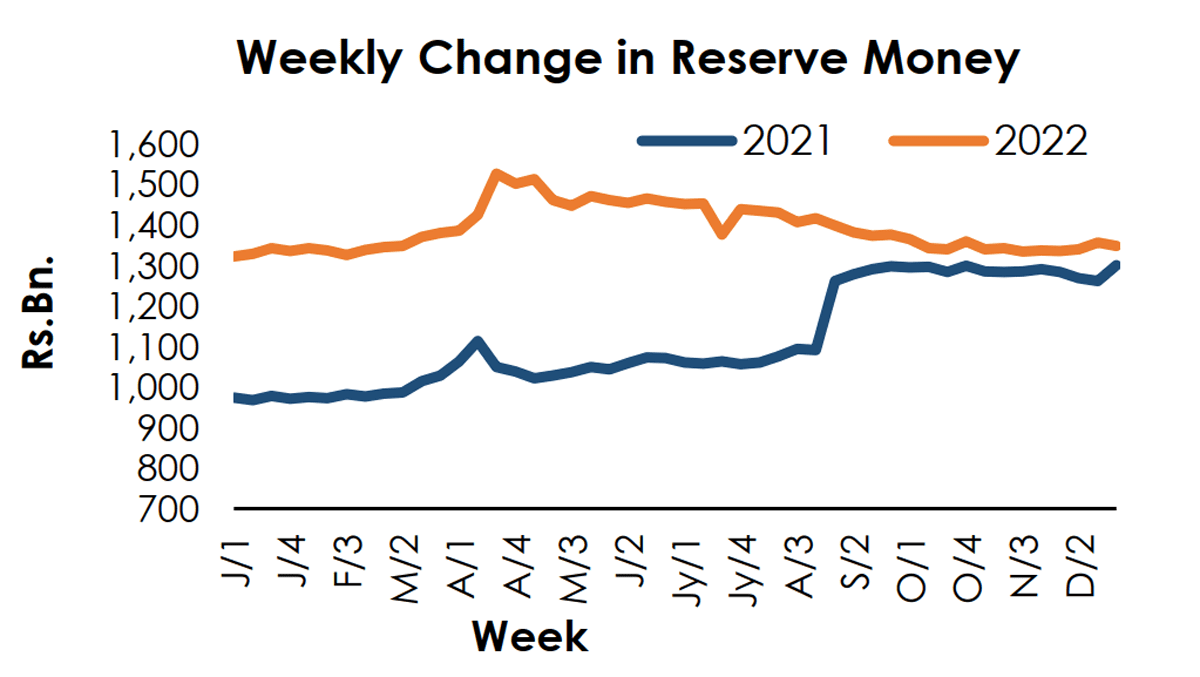

The central bank has started injecting liquidity beyond overnight longer-term basis to banks from around January 2022, to ease liquidity shortages and competition for deposits, he said.

Liquidity shortages emerge in a pegged exchange rate regime from dollar outflows coming from credit driven by artificially low interest rates compared to the balance of payments.

The emergence of new liquidity shortages can be stopped by a float or raising rates to stop excess credit.

Any interest rate payment to the central bank by the Treasury which is not a book transaction could also increase liquidity shortages (a transaction other than an internal roll-over of central bank held Treasury bills or bond coupons).

The central bank now holds over 2.5 trillion rupees of domestic Treasuries as a result sterilizing reserve losses and injecting liquidity outright through price controls on bond auctions.

In past crises liquidity shortages begin to ease quickly after external stability is restored by a rate hiked and a float.

This time due to China delaying debt assurances to the International Monetary Fund, after Sri Lanka’s debt was declared unsustainable by the agency, rate falls are delayed. (Colombo/Feb05/2023)